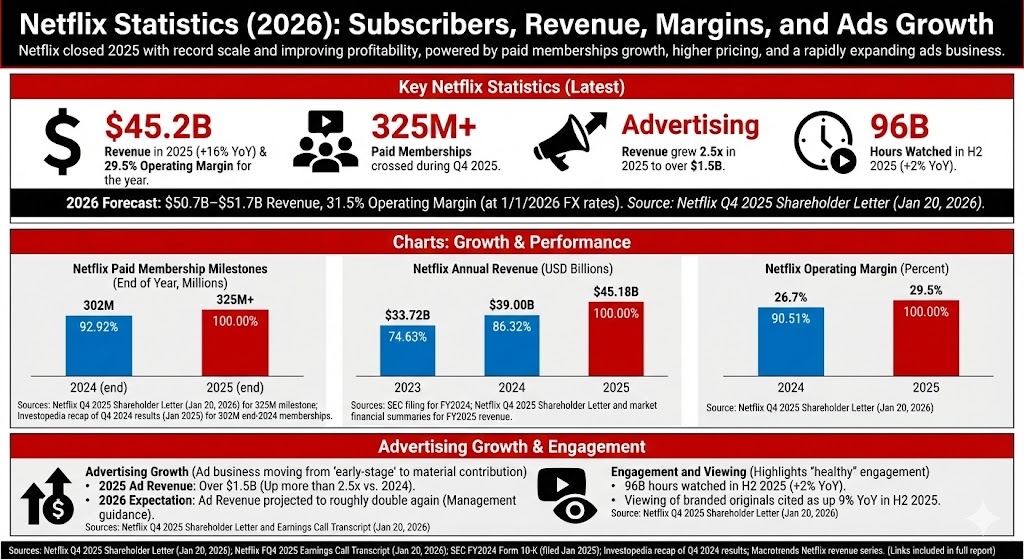

Netflix closed 2025 with record scale and improving profitability, powered by paid memberships growth, higher pricing, and a rapidly expanding ads business.

Key Netflix Statistics (Latest)

- $45.2B revenue in 2025 (+16% YoY) and 29.5% operating margin for the year.

- Netflix crossed 325M paid memberships during Q4 2025.

- Advertising revenue grew 2.5x in 2025 to over $1.5B.

- In H2 2025, members watched 96B hours on Netflix (+2% YoY).

- Netflix forecast $50.7B–$51.7B revenue and 31.5% operating margin for 2026 (at 1/1/2026 FX rates).

Source: Netflix Q4 2025 Shareholder Letter (January 20, 2026).

Chart: Netflix Paid Membership Milestones (End of Year, Millions)

| Label | Bar | Value | ||

|---|---|---|---|---|

| 2024 (end) |

| 302M | ||

| 2025 (end) |

| 325M+ |

Max = 325M+. Widths: 2024 (end) 92.92%, 2025 (end) 100.00%.

Sources: Netflix Q4 2025 Shareholder Letter (Jan 20, 2026) for 325M milestone; Investopedia recap of Q4 2024 results (Jan 2025) for 302M end-2024 memberships.

Financial Performance

Netflix’s topline growth accelerated into 2025, while operating margin expanded versus 2024—helped by scale efficiencies and growing ad revenue alongside subscription pricing and mix.

Chart: Netflix Annual Revenue (USD Billions)

| Label | Bar | Value | ||

|---|---|---|---|---|

| 2023 |

| $33.72B | ||

| 2024 |

| $39.00B | ||

| 2025 |

| $45.18B |

Max = $45.18B. Widths: 2023 74.63%, 2024 86.32%, 2025 100.00%.

Sources: SEC filing for FY2024 (shows 2023 and 2024 total revenues); Netflix Q4 2025 Shareholder Letter and market financial summaries for FY2025 revenue.

Chart: Netflix Operating Margin (Percent)

| Label | Bar | Value | ||

|---|---|---|---|---|

| 2024 |

| 26.7% | ||

| 2025 |

| 29.5% |

Max = 29.5%. Widths: 2024 90.51%, 2025 100.00%.

Source: Netflix Q4 2025 Shareholder Letter (January 20, 2026).

Advertising Growth

Netflix’s ads business moved from “early-stage” to material contribution in 2025, with management pointing to continued growth as its ad-tech platform scales and measurement improves.

- 2025 ad revenue: over $1.5B (up more than 2.5x vs. 2024).

- 2026 expectation: ad revenue projected to roughly double again (management guidance).

Sources: Netflix Q4 2025 Shareholder Letter (Jan 20, 2026) and Earnings Call Transcript (Jan 20, 2026).

Engagement and Viewing

Netflix highlighted “healthy” engagement, with H2 2025 viewing up year over year—driven by increased viewing of Netflix-branded originals.

- 96B hours watched in H2 2025 (+2% YoY).

- Viewing of branded originals was cited as up 9% YoY in H2 2025.

Source: Netflix Q4 2025 Shareholder Letter (January 20, 2026).

Sources

- Netflix Q4 2025 Shareholder Letter (January 20, 2026): https://s22.q4cdn.com/959853165/files/doc_financials/2025/q4/FINAL-Q4-25-Shareholder-Letter.pdf

- Netflix FQ4 2025 Earnings Call Transcript (January 20, 2026): https://s22.q4cdn.com/959853165/files/doc_financials/2025/q4/Netflix-Inc-_Earnings-Call_2026-01-20_English-1.pdf

- SEC FY2024 Form 10-K (filed January 2025; includes FY2023 and FY2024 revenues): https://www.sec.gov/Archives/edgar/data/1065280/000106528025000044/nflx-20241231.htm

- Investopedia recap of Q4 2024 results (for end-2024 memberships): https://www.investopedia.com/netflix-earnings-q4-fy-2024-8777613

- Macrotrends Netflix revenue series (supports FY2025 revenue figure formatting): https://www.macrotrends.net/stocks/charts/NFLX/netflix/revenue